Helping members get the best outcomes from their post-retirement investment options for drawdown

Since the retirement flexibilities came into force in 2015, people have changed the way they use their Defined Contribution (DC) pension accounts. The number of people buying annuities has declined and the number of people cashing-in or using drawdown has increased.

Data from the first nine months following the introduction of flexibilities shows that the number of people taking drawdown now exceeds the number of people taking an annuity.

|

Number |

Total |

|

|

Cash |

213,000 |

£3.0bn |

|

Annuity |

61,700 |

£3.3bn |

|

Drawdown |

63,600 |

£4.2bn |

Source: Association of British Insurers

In the aftermath of the announcement, default investment options have received a lot of attention for the pre-retirement phase; there has been less focus to date on achieving the best outcomes for members in their post-retirement phase.

Average pot sizes of those using drawdown is larger than the average for annuity or cashing-in; this is encouraging as it suggests that people are considering their options and many are taking advice to help them find the right solution for their retirement.

With many individuals investing a substantial proportion of their retirement savings in drawdown, a big question for scheme providers is how can they help members get the best outcome from their post-retirement drawdown?

Meeting member needs

NEST has conducted research with retirees and developed a blueprint for meeting the needs of their members. Although NEST’s members are not typical for all schemes, the research reveals some powerful insights. It suggests that member needs change as they move through retirement and that this journey requires three types of provision: a cash fund, income drawdown fund and protection for later life.

NEST proposes some guiding principles and a two phased approach, with a default investment and income strategy, to help members who are not well equipped to make the decisions for themselves. The proposal is put forward as a blueprint for what schemes should think about when constructing a strategy.

When thinking about the member perspective and what they want when they choose to drawdown, it’s valuable to consider what they are trying to achieve and what sources of income they have available. It may be the case that members want an income for life that is stable and increases over time but it is not necessarily the case that this captures what they want from all of their pots in retirement.

For those retiring in the near future, in addition to a pot for drawdown, they are likely to have one or more Defined Benefit (DB) pensions and almost everyone will qualify for a State pension. Members will be asking themselves the question of how each and every pot fits into their needs and the demands on their pot for drawdown will be affected as a result.

Considering the governance process

As well as meeting members’ needs, it is important to consider the governance process and the respective responsibilities of members and Trustees. Fiduciaries should think through their role and not sidestep it in helping members with their drawdown investments.

Best practice needs to bring together what members are looking for with the investment risks they face, which suggests a need to understand member objectives that can provide a framework for thinking about investment solutions.

Ensuring a robust risk framework

When designing solutions, it is important to have a robust risk framework. One of the key risks for individuals drawing an income is the risk that the fund will run out before the member dies, or ‘exhaustion’ risk. Managing against that risk suggests that a bond strategy on its own will not protect the member against exhaustion. However, we also need to guard against the timing risk. Members who invest in equities and face an investment reverse in the early years of drawdown may never recover from that shock to their living standards. Individuals must utilise their broader flexibility to allow them to weather this downside risk.

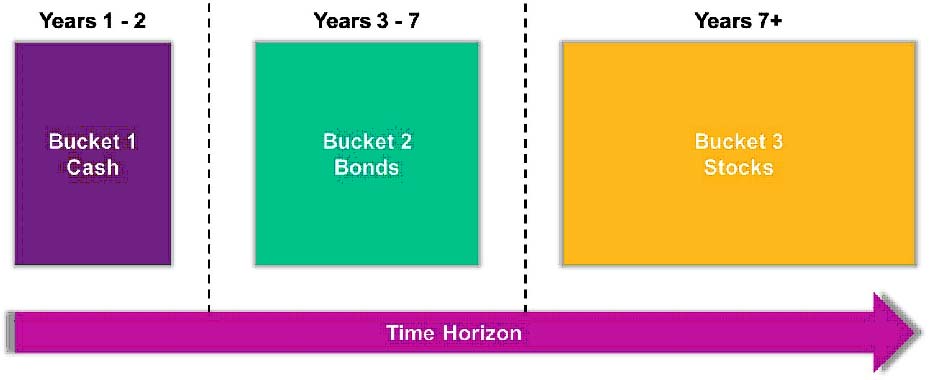

Engaging members to allow the appropriate protection against the risks they face, in order to achieve their mission, suggests dividing the member’s portfolio into different assets depending on the time horizon for the objective. These assets would include cash for short term needs, bonds for income and equities for longer term protection.

As members age, their mission is likely to change and the benefits of a secure income and annuities may become more valuable. For some, combining a drawdown and an annuity purchase strategy may be appropriate.

Establishing guiding principles

It may be helpful to establish your own guiding principles to use when assessing different strategies for drawdown investment.

These principles should take into consideration what members need, as well as anticipate how they might interact with any other choices and savings an individual might have. They should also take into account what help and advice may be made available to them. The principles might, therefore, cover costs, accessibility to capital, understandability and oversight or governance.

In the future, the need for better drawdown investment strategies will grow and we will have more data about what members need. We should also anticipate that the needs of members will change as DC becomes the main or only source of retirement income outside of State benefits. Perhaps the one certainty is that the solutions in the near future for drawdown investors will continue to change and adapt to members need.