Why LifeSight

A brighter future for your employees

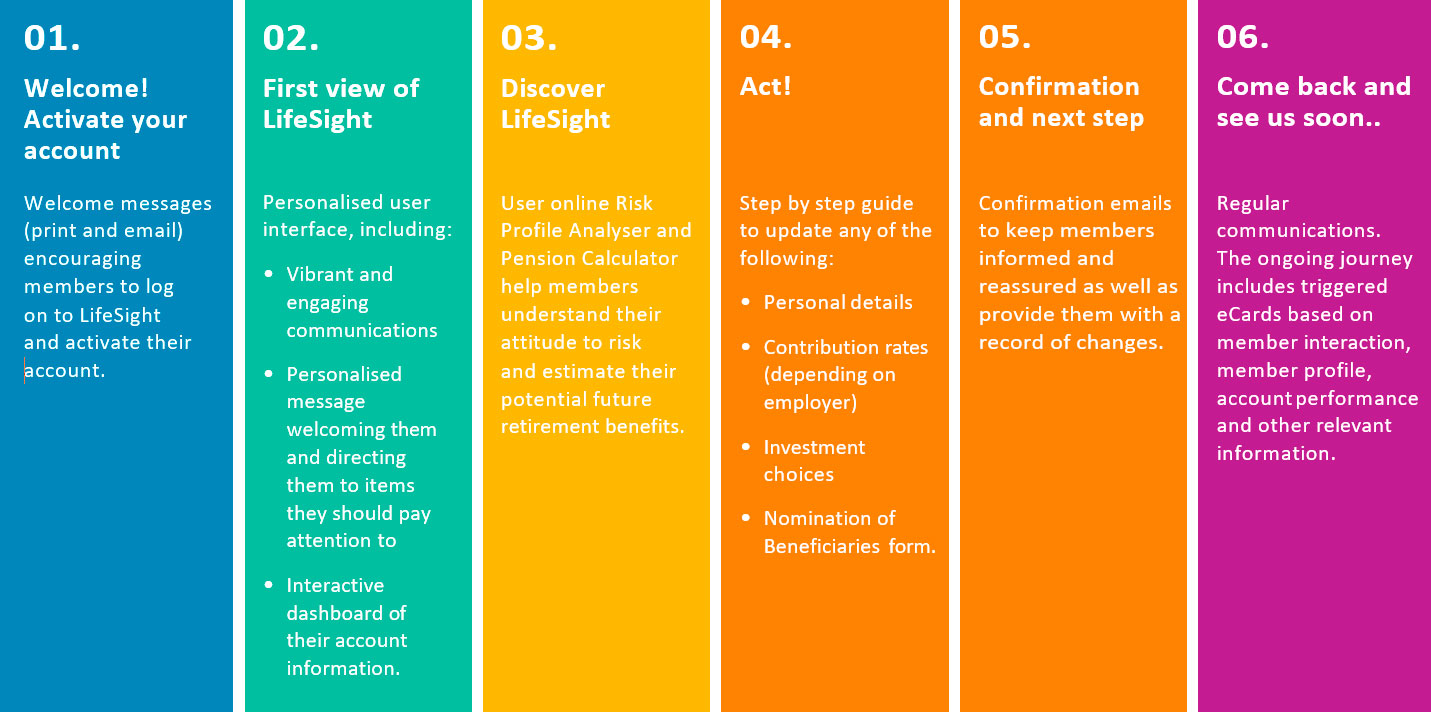

LifeSight goes further than looking after the day-to-day management of the scheme. We actively work to improve members’ retirement outcomes. Personalised communications and simple-to-use online and mobile support tools improve engagement, understanding and outcomes for members. LifeSight’s intuitive retirement planning tools also help make options easier to understand so members can make informed decisions about cash, pension and ARF (also known as “drawdown”) options. Just as LifeSight will continue adapting to the changing pensions landscape, our technology will continue to evolve too.

Additional resources

Ensuring good governance

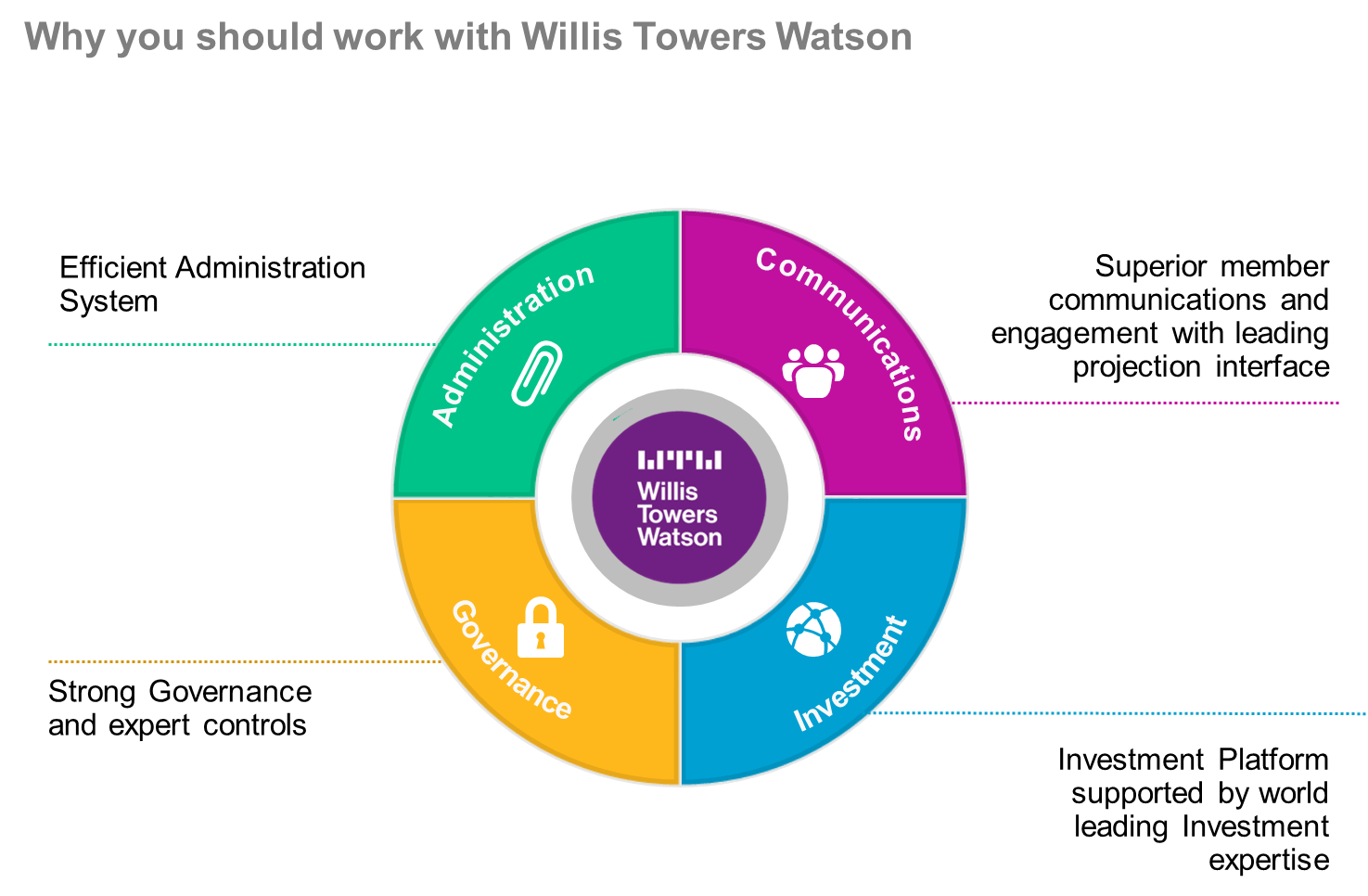

Delivering robust governance and expert controls with our optional trustee company acting as trustee. This leads to reduced workflow and for the company and HR teams, working in the best interest of all members.

The key components of our proposed solution are enhanced member communications, an investment platform with the fund design underpinned by our global investment experts, all of which is overseen by a robust trustee governance framework. All the pension plan services are provided by our Registered Administrator using our proprietary inhouse secure administration and record keeping platform.

Additional resources

Learn more about good governace and the implications from IORP II

Learn more about our MasterTrust solution

Smarter investments

LifeSight offers a full range of investment strategies built to respond to and consider the different needs of members. Our leading edge LifeSight investment funds are overseen by our global investment strategists to deliver innovative and adaptive investments to DC scheme members.

The LifeSight fund range incorporates WTW's best ideas in cost effective fund allocations. Among the features of the LifeSight fund range are:

- Access to a range of risk related fund choices suitable for differing member risk preferences and benefit choices

- Utilisation of a range of asset class building blocks beyond the traditional regional equity focus in order to provide access to cost effective diversification and investment return opportunities in our core diversified funds

- Inclusion of Economic, Social and Governance (ESG) tilts to our core funds in order to reflect the growing importance of these factors in delivering sustainable investment returns. This also helps future proof the investment strategy as IORP II will require Trustees’ to build in ESG factors into their investment decision making processes and to state how ESG factors are taken into account in their investment principles.

This research helps direct the DC investment solutions offered via LifeSight for our clients in Ireland, the UK and Belgium.

Additional resources