Trustee/Employer Involvement – How far is enough?

Generally, in DC schemes, the Trustee or employer responsibility is traditionally viewed as ending when the member walks out the door for the last time and hangs up their overalls or turns off their office light or laptop. However, with a little bit of assistance using our LifeSight solution, the employer and/or Trustee could greatly help their retiring member to a better life post-employment.

The recent Interdepartmental Pensions Reform and Taxation Group (“IDPRTG”) considered, amongst other issues, Approved Retirement Funds (ARFs) in their recent report, with the most public or eye-catching highlight being a proposal to replace ARFs with a reconstituted PRSA product.

In 2018 the IAPF carried out research showing the ARF market was in the region of €8-10b and growing at €1b per annum. The IDPRTG also has consistent figures, with updated values of approx. €12.5bn for ARFs and €2.5bn for AMRFs. It is likely that at least some of these ARF holders found themselves to be in a retirement world that they didn’t expect and having to make financial decisions for which they were ill-equipped. We would like to think that the majority of such “retirees” would have engaged in detailed financial advice at the point of retirement, but , for many who did so, this was likely to have been the first such occasion on which they had done so. A sad fact, unfortunately, is that workers globally do not engage sufficiently during their working lives when contributing to a pension scheme with Trustees making the default fund decisions for them. However, engagement would be preferable especially before the retirement path is established, realistically at least 5-10 years before taking benefits. This is a key issue that Trustees need to focus on throughout the employment life, but especially during the last 10 years nearing retirement (realistically probably from mid-40’s or early 50’s).

The expectation is that retirees, in making possibly one of the biggest financial decisions of their lives i.e. deciding how to plan and invest their retirement pot to last them to their dying days, would treat the decision with the time and respect it deserves. However, the reality is that many forego independent financial advice to help with the decision-making process and ultimately make sub-optimal choices. Trustees could also do much more in terms of achieving better member engagement, especially in this later stage. While there is a wide array of quality financial advice available, members sometimes have difficulties in assessing different advisors and therefore it is possible for employers and/or Trustees to help in this decision-making process.

What can Trustees do?

In line with best practice and Pension Authority (PA) guidelines, most Trustees are quite paternalistic in providing appropriate default strategies, lifestyle glide paths and various landing points for members approaching retirement. LifeSight, with the benefit of our online pension calculators and helpful projection tools, has ensured it is possible for members to determine whether cash, drawdown or pension is the best option if maximising their tax-free lump sum is the key.

But is this far enough? Could the employer and/or Trustees just hold the retiree’s hand a little bit longer?

Under the Pensions Act, the Trustees need to make arrangements for payment of benefits as provided for under the rules of the scheme as they become due, and their job is then done. Trust Law extends this a little further in obligating Trustees to act in members’ best financial interests and to implement retirement options at the direction of the member.

It is fair to say the Pension Authority guidance is quite broad on the subject matter. It expects good governance and for Trustees to put an appropriate system in place regarding any payment of benefits and in doing so, should ensure procedures concerning benefit payments are clearly documented in a Service Level Agreement with the administrator. An administrator should issue a report at least annually to the Trustees.

In addition, Trustees must ensure that members are provided with details of the options available and the choices which are open to them in deciding upon their benefits. The Leaving Statement Option is one of the key information documents provided to members and should be a key focus opportunity for Trustees to clearly inform members of their options.

The PA code references value, security & suitability for annuities but they are probably even more relevant to ARF and doesn’t really address the issue of whether the choice is ARF or annuity, much less the details of what makes a good ARF.

They stress that “proper arrangements” should be in place to allow for the transfer of benefits from the scheme and that Trustees should record all information involved in the payment of benefits to ensure that their administrational and monitoring responsibilities are kept up to date.

“In-house” Drawdown

It is possible that, if it was a choice available to them, some pension scheme members would prefer not to have to move to a different provider or product at retirement, and continue to have their retirement savings managed within the funds in which they were accumulated.

Known as “in-house income drawdown” and being considered in the UK, this is a method seen to benefit the member in a number of ways:

- Potential for material reduction in the member fees and charges

- Seamless transition of assets from pre to post retirement (indeed, no transition)

- Greater oversight of the underlying investment manager

In the US, many take this option of leaving the money in their company scheme. They can either begin taking withdrawals or wait and let their money continue to grow on a tax-deferred basis. Since they aren’t required to begin taking withdrawals until the tax year in which they turn 70-1/2 years old, this could mean thousands of dollars in additional gains. Another incentive to consider this route in the US is that money in a US DC account or 401(k) is generally protected from creditors and bankruptcy. So, if either of these was a concern at any point in the member’s life, then they are encouraged to leave their account where it is.

However, there are many real and material differences in the issues involved in group pension schemes and post retirement funds, and Trustees (or associated employers) in Ireland may not be either willing or equipped to deal with these.

Member Advice

We have already referred to the long-standing difficulties in achieving member engagement during the employment stage, and this becomes a much more pressing issue as members draw nearer to retirement.

In particular Trustees need to consider whether they are currently engaging and communicating with members on the following aspects;

- The key choice of Drawdown or Pension and how to best prepare for either option.

- Is there real alignment between pre- and post-retirement pension investing?

- Is there sufficient clarity on the transition from pre to post-retirement pension?

It is clear that better member engagement is critical to better pension outcomes. We believe personal financial advice is the key to better member engagement, and the big question is how to pay for this.

Broadly one, or a combination of the member, employer or Trustees must pay for this advice. If the member pays, the main question is whether to pay from their own pension fund units, or pay separately, with the latter normally facing the greatest resistance, and this is not a popular option for most members.

Currently, in the post retirement world, the member pays from their fund units. This may be a less frequent practice in the pre-retirement world environment and would need to be specifically allowed for in a contract and under regulation. Administratively, it should be feasible and would hopefully be a relatively small proportion of a members’ funds, although that is dependent on the fund size.

While employers often pay for group member briefings, it is less frequent that it extends to one-to-one detailed member financial advice. Employers can pay for this directly or alternatively from excess employer pension units, where available. These options mostly exists with larger employers.

The Pension Act provides Trustees with a statutory discharge from liability, once certain conditions are complied with, where they give effect to members’ investment directions pre-retirement. At present, the Pensions Act does not provide Trustees with an equivalent level of statutory protection in a post-retirement context.

How LifeSight can help?

There are several possible developments alluded to in the aforementioned IDPRTG Report that may change the pension landscape in Ireland and each will have its own impact on member outcomes but having brought members through their pre-retirement journey Trustees should be aware that a little more hand holding could make a significant difference.

In saving for retirement, most members typically invest in the Trustees’ default fund choice. However, through LifeSight, a member will also have access to clear risk assessment and investment modelling tools allowing them to tailor their investment strategy using two main variables:

- Their attitude to risk.

- Whether they intend to take an annuity, drawdown (i.e. ARF) or simply take cash at retirement.

The default and self-select strategies are created by the award-winning Willis Towers Watson Investment Management team, taking advantage of their global investment thinking and experience in more DC mature markets than Ireland. These strategies are delivered at a low-cost to members given the scale of Willis Towers Watson and the use of index-tracking investment options.

Members can also access self-selected funds and create their own strategy between different risk profiles with the aim of matching their specific retirement plans should they wish. The tools and explanatory guides facilitating these choices have been extensively consumer-tested to ensure they are in plain English and are welcoming and user-friendly.

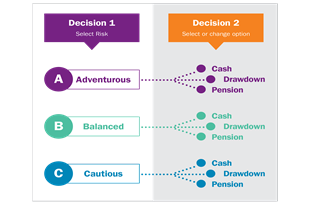

The “Help me do it” option, offers a range of 9 Lifecycle strategies to make these decisions easier. These Lifecycle strategies offer three initial levels of investment risk: Adventurous, Balanced and Cautious. The transition of each of these 3 strategies to 3 potential retirement targets (Cash, Pension and Drawdown) occurs automatically over the 10 years to the members normal retirement age.

Along with periodic standard eCards or nudges on properly maintaining their LifeSight Account, members also receive personalised eCards triggered by certain key events such as 5 years and 1 year from retirement which encourage members to seek further advice.

These eCards allow members to receive bite-size, targeted information through their email on any device providing them with information on specific topics and easy steps to complete important actions. Links are provided to bring members straight to their LifeSight Account where they can carry out the actions with just a few clicks.

Members can also subscribe or unsubscribe to the eCards, so they always retain control. Trustees can therefore be more comfortable that there are supports to effectively hold the hands of members as they travel through their retirement planning journey and beyond.